does kentucky have sales tax on cars

Hmm I think. You can find these fees further down on the page.

Rising Value Of Vehicles Could Increase Cost To Renew Registration In Kentucky News Wdrb Com

Does kentucky have a state sales tax.

. The customer comes back several days later to complete the registration process. Petrie added that HB 8 makes no changes in the corporate income tax or the limited liability entity tax LLET nor does it include a rumored expansion of the sales tax to traditionally non-taxed. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

State Gasoline Tax Rate cents per gallon 2600. Below is a brief summary of each. Yes there is no sales tax exemption that applies specifically to military personnel.

Groceries and prescription drugs are exempt from the Kentucky sales tax. KRS 139010 et seq Sales tax6 percent. After that there is a much smaller property tax charged when you renew your registration every year.

Sales and Use Tax Laws are located in Kentucky Revised Statutes Chapter 139 and Kentucky Administrative Regulations - Title 103. On used vehicles the usage tax is 6 of the current average retail as listed in the Used Car Guide or 6 of the total consideration paid. Whether you have your eyes on a practical Civic a spacious Accord family-friendly Odyssey or a sporty Fit take advantage of Kentuckys new law to save big when you trade in your current ride at Neil Huffman Honda.

If there is a loan of the car there is an additional 22 fee. Kentucky does not have additional sales taxes imposed by a city or county. The Kentucky state sales tax rate is 6 and the average KY sales tax after local surtaxes is 6.

Can sales tax be refunded. There are no local sales and use taxes in Kentucky. Sales tax is imposed on the retailer for the privilege of making retail sales of tangible personal property or taxable services within Kentucky.

Usage Tax A six percent 6 motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. Do you have to pay sales tax on a car in Kentucky. Aside from state and federal taxes many Kentucky residents are subject to.

Are services subject to sales tax in Kentucky. Kentucky Department of Revenue. Classic cars have a rolling tax exemption ie vehicles manufactured more than 40 years before 1 January of that year are automatically exempt from sales tax and vehicles used for certain types of forestry and agriculture are as well.

Click for a comparative tax map. How much does it cost to transfer a vehicle in KY. 15000 X 06 900.

Covers the rules and regulations for dealers regarding tax payments refunds refund permits records invoices legal action penalties. Kentucky again enacted a sales and use tax effective on July 1 1960. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

2022 Kentucky state sales tax. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. On this page we have gathered for you the most accurate and comprehensive information that will fully answer the question.

The title transfer fees in Kentucky are just 9. Sales Tax Paid to a Kentucky Vendor S9 - attach a copy of the receipt from the seller. Kentucky imposes a flat income tax of 5.

501 High Street Station 32. Every year Kentucky taxpayers pay the price for driving a car in Kentucky. Kentucky charges a 6 usage tax on the value of a vehicle every time it is registered to a new owner in-state.

Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. 425 Motor Vehicle Document Fee. Depending on where you live you pay a percentage of the cars assessed value a price set by the state.

Email Send us a message. However Kentucky sales tax does not apply to motor vehicles covered under the motor vehicle usage tax exemption for nonresident military personnel under KRS 1384704. State and Local General Sales Tax Collections per Capita.

Counties and cities are not allowed to collect local sales taxes. Division of State Valuation. The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of which services can be taxed.

775 for vehicle over 50000. As an example I bought a car for 19500 in March and had to pay almost 1200 for usage tax. Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth.

If the vehicle is registered in Kentucky sales tax. The tax is collected by the county clerk or other officer with whom the vehicle is. If you were to buy a 25000 car and had a trade-in worth 15000 your sales tax would be on 10000 instead of the full 25000.

There are currently four statutes and two regulations that direct the manufacture and sale of motor vehicles in Kentucky. There are some other loopholes too. For vehicles that are being rented or leased see see.

Previously taxed services included those which modify or repair a product. 635 for vehicle 50k or less. The use tax is im-posed on the storage use or other consumption of tangible per-sonal property in.

If your tax rate is 6 that would result in a savings of 900. Motor Vehicle Property Tax. An individual titles a vehicle and pays Usage Tax but the person does not have insurance so the vehicle is not registered.

The retailer must pass the tax along to the consumer as a separate charge. Labor and services such as car repair landscaping janitorial services and. The tax rate is the same no matter what filing status you use.

That means youd end up paying just 900 in tax rather than 1500 when you factor in Kentuckys 6 percent motor vehicle tax. The sales tax is imposed upon all retailers for the privilege of making retail sales in Kentucky. Car tax as listed.

In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. This way you dont have to pay a sales tax on your car in the new state when you re-register it. Exact tax amount may vary for different items.

Yes effective July 1 2018 both parts and labor are subject to the 6 Kentucky sales tax.

Kentucky Drivers Might See Car Registration Sticker Shock

Vintage Cadillacs Paducah Paducah Kentucky Used Cars And Trucks

Nascar Official Home Race Results Schedule Standings News Drivers Nascar Heat Paint Schemes Nascar Racing

/cloudfront-us-east-1.images.arcpublishing.com/gray/GY7EKOZVSVHZXL3NZFRJUBIA34.png)

Ky Lawmakers Propose Bills To Mediate Car Tax Increases

Ky Lawmakers Could Have Ended The Car Tax They Now Pledge To Curb Lexington Herald Leader

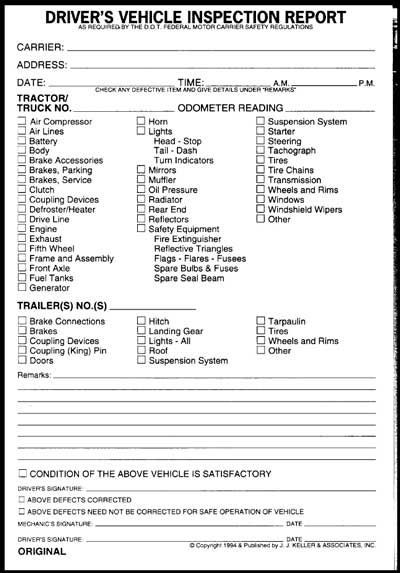

Kentucky Vehicle Inspection Form 15 Things To Avoid In Kentucky Vehicle Inspection Form Vehicle Inspection Vehicle Maintenance Log Inspection Checklist

Cash For Your Car In Kentucky Free Same Day Pickup Car Title Kentucky Id Card Template

/cloudfront-us-east-1.images.arcpublishing.com/gray/GY7EKOZVSVHZXL3NZFRJUBIA34.png)

Ky Lawmakers Propose Bills To Mediate Car Tax Increases

Finance Blog Wrenne Financial Planning Lexington Kentucky Home And Auto Insurance Car Insurance Homeowners Insurance

Kentucky Drivers Face Higher Tag Prices Due To Rising Value Of Used Vehicles

What S The Car Sales Tax In Each State Find The Best Car Price

Rising Value Of Vehicles May Lead To Property Tax Increase In Kentucky News Wdrb Com

Nj Car Sales Tax Everything You Need To Know

Sales Tax On Cars And Vehicles In Kentucky

Old Trucks Of Ky Used Cars And Trucks Paducah Kentucky Old Trucks

Kentucky Drivers Face Higher Tag Prices Due To Rising Value Of Used Vehicles